The issue that lies at the heart of

Legal Dictations

The issue that lies at the heart of

Owing to a steep depreciation in the value of Indian Rupee against the US Dollar, the Government of India, under Section 211 of Companies Act, 1956, issued a notification giving an option to assessees, to either take the entire amount of loss due to exchange rate movement, to the profit and loss account; or to defer the impact of such loss by capitalizing such losses with the cost of the assets so acquired. The Respondent-Assessee, therefore, was of the view that it was for the Respondent-Assessee to decide how it would choose to absorb the impact arising out of exchange rate differences.

| Test Type | PAID |

|---|---|

| Total Words | 500 Words |

| Words Per Minutes | 100 WPM |

| Time | 25 min |

Why Steno Architect Certification Training

Live Interactive Learning

- World-Class Instructors

- Expert-Led Mentoring Sessions

- Instant doubt clearing

Lifetime Access

- Course Access Never Expires

- Free Access to Future Updates

- Unlimited Access to Course Content

24x7 Support

- One-On-One Learning Assistance

- Help Desk Support

- Resolve Doubts in Real-time

Hands-On Project Based Learning

- Industry-Relevant Projects

- Course Demo Dataset & Files

- Quizzes & Assignments

Industry Recognised Certification

- Steno Training Certificate

- Graded Performance Certificate

- Certificate of Completion

Like what you hear from our learners?

Take the first step!

Dictation

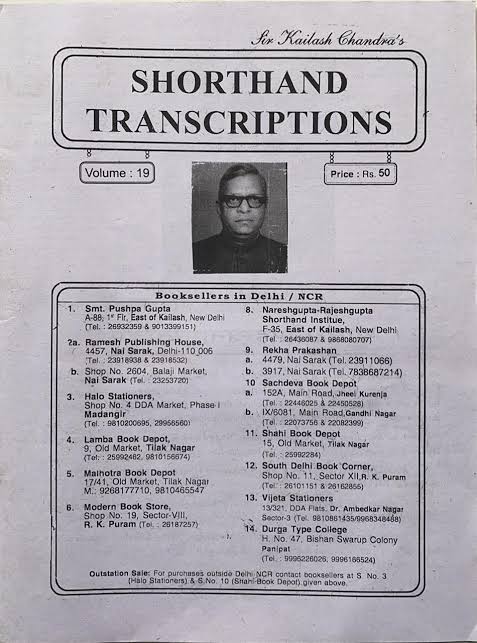

Kailash Chandra Vol. 21

50 min

Legal Dictations

25 min