In the the light of the

Patna Civil Court Steno Dictations

In the the light of the

n the the light of the legal position stated hereinabove, it is very clear that no tax on the sale or purchase of goods can be imposed by any State when the transaction of sale or purchasel takes place in the course of import of goods into or export of the goods out of the territory of India. Thus, if any transaction of sale or purchase takes place when the goods are being imported in India or they are being exported from India, no State can impose any tax thereon.

| Test Type | PAID |

|---|---|

| Total Words | 400 Words |

| Words Per Minutes | 100 WPM |

| Time | 17 min |

Why Steno Architect Certification Training

Live Interactive Learning

- World-Class Instructors

- Expert-Led Mentoring Sessions

- Instant doubt clearing

Lifetime Access

- Course Access Never Expires

- Free Access to Future Updates

- Unlimited Access to Course Content

24x7 Support

- One-On-One Learning Assistance

- Help Desk Support

- Resolve Doubts in Real-time

Hands-On Project Based Learning

- Industry-Relevant Projects

- Course Demo Dataset & Files

- Quizzes & Assignments

Industry Recognised Certification

- Steno Training Certificate

- Graded Performance Certificate

- Certificate of Completion

Like what you hear from our learners?

Take the first step!

Dictation

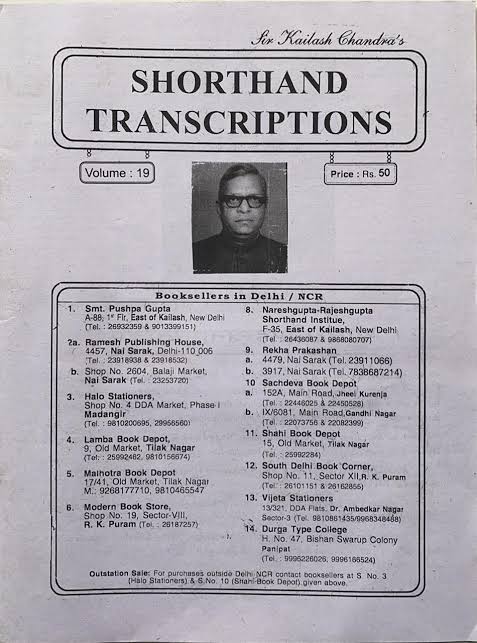

Kailash Chandra Vol. 21

50 min

Legal Dictations

25 min